05.17 / 2019

05.17 / 2019

421

421

How can we boost their development and prevent them from falling into poverty again on a sustainable internal impetus basis? Continuous innovation and exploration and a long-term mechanism to stabilize poverty alleviation are required for us to achieve sustainable economic and social development.

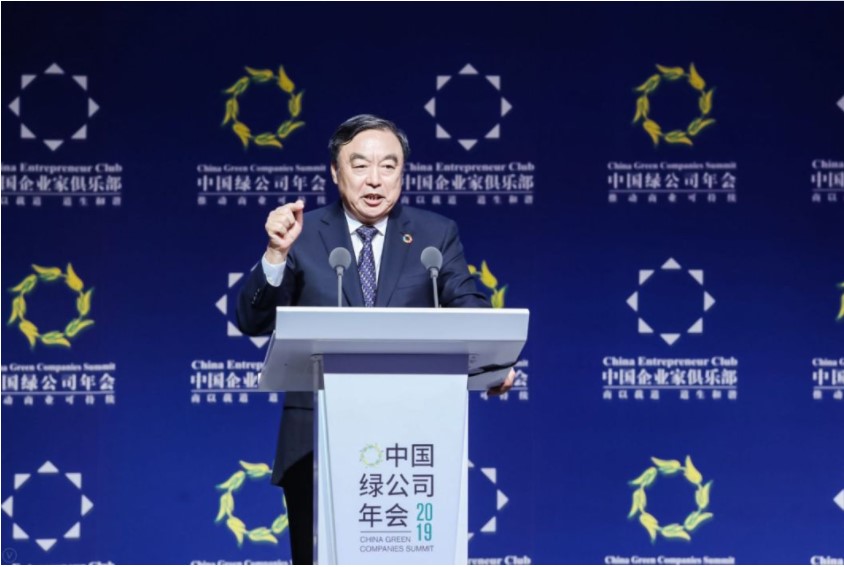

-- Ma Weihua, Chairman of the Board of Directors of the China Global Philanthropy Institute

On April 22-24, "2019 China Green Companies Summit" was held in Dunhuang, Gansu Province, hosted by the China Entrepreneur Club. Ma Weihua, Chairman of the Board of the Directors of the China Global Philanthropy Institute, Chairman of the China Entrepreneur Club and former President of China Merchants Bank, delivered a keynote speech entitled "Sustainable Development, Impact Investing and the Anti-poverty Fight".

Full speech by Chairman Ma Weihua

Dear leaders and friends, the desert of Dunhuang is full of spring scenery. China Green Companies Summit is held in vibrant Dunhuang, Gansu Province. I am very grateful to the provincial Party committee and government, relevant authorities and entrepreneurs for their support and participation.

The background of the China Green Companies Summit is that China has made a historic breakthrough in the struggle against poverty and has entered the decisive stage of tackling key problems of poverty alleviation. Over the past six years, under the leadership of the CPC Central Committee and the State Council, China has made historic progress in its fight against poverty. Over the past six years, the number of the poverty population in China has fallen from nearly 100 million to less than 20 million, a decrease of 13 million every year on an average basis. In the past five years, poverty population in Gansu has decreased from 5.52 million to 1.11 million, and decisive progress has been made in tackling the key problems of poverty alleviation. But the task grows harder and harder as the time flies by. and now is the hardest time of poverty alleviation.

How can we boost their development and prevent them from falling into poverty again on a sustainable internal impetus basis? To achieve sustainable economic and social development, we must continue to innovate and explore.

Today I'm going to talk about "Sustainable Development, Impact Investing and Anti-poverty Fight". As is known to us, in the last 20 years, due to the scientific and technical revolution, financial innovation, Globalization, the exponential growth of capital markets and global economy, companies like Apple and Amazon appeared with market capitalizations of trillions USD. But we also see that there are many problems in the process of economic development and wealth accumulation, with 2 billion people living on less than USD 3 a day and 1.6 billion without basic sanitation. If coupled with the ecological crisis, global sustainable development is full of hidden troubles. Therefore, the United Nations has decided on a sustainable development plan for 2015-2030, proposing 17 indicators (SDG for short, for more information, please refer to the end of the article, Philanthropy Online Academy × SDGs Animation Classroom Series of UNDP), the first of which is anti-poverty and the second is anti-hunger.

How much is the financing gap for developing countries and emerging markets to achieve the 17 indicators? USD 3.9 trillion. Yet the sum of all government investments, and a variety of charitable donations is less than USD 1.4 trillion. How to solve this problem? Obviously, it is not enough to be solved by government investments and by donations alone.

Thinking about it from another view, many of them are generated in economic activities. If every economic activity and each investment not only pursue positive financial returns, but also take account into positive social impact, these problems will be increasingly smaller. Impact investing seeks positive financial returns and has a positive and quantifiable social impact, which are a new concept of global investment advocated by the United Nations.

I think this idea is in line with the nature of this summit. Then what is the nature of business? It is not profit-oriented, but to carry forward commercial civilization, to promote entrepreneurship, and to pursue sustainable economic and social development. These problems should be solved by industrial and commercial means. This kind of investment has the feature of humanistic care and the sustainable development, and has erected the bridge of investment return and the social value win-win. What is entrepreneurship? It means the consistence of innovation and entrepreneurship enterprising and a sense of responsibility to serve the community.

According to the United Nations, the growth of impact investing is very rapid, will become a global investment trend. Besides, we predict that China will become a major impact investing country, because the impact investing is in line with the law of historical development of philanthropy as a combination tools of philanthropy and finance. The development of productive forces determines the existence of philanthropy. Today, with the rapid development of scientific and technical revolution and capital market, the traditional philanthropy must be transformed into modern philanthropy, which is the inevitable result of historical development.

Impact investing complies with the trend of demanding for People for Social Good, Community for Social Good and Capital for Social Good in today's society. I investigated the Domini 400 Social Index in the United States and chose 400 stocks with good economic returns and significant social impact in the American market. Over the past 20 years, their earnings have outpaced the S & P 500 Index. Seen from the capital market, it is a trend for Business for Social Good and Capital for Social Good.

Impact investing is also in line with China's Five Development Concept:

The first is innovation. It is not only the innovation of philanthropy, but also the innovation of investment.

The second is harmonization. If an investment has good economic and social benefits, it is the greatest harmonization.

The third is openness. Impact investing is a new concept of international investment advocated by the United Nations. In the development process involving capital, international exchanges, and transnational capital flows, many international impact investing emphasis on China's market and "The Belt and Road" strategy for going out. The impact investing will also be welcomed by the host country if it is treated as a concept.

The fourth is green. The advocacy of impact investing is to bring quantifiable and measurable impact on the environment and society, therefore green is the main content and due meaning of impact investing.

The fifth is sharing. All we do focus on the vulnerable groups at the bottom of the pyramid and on the poor. So everything we get should make the world a better place for all to share.

Impact investing is also a practical step for China's economic development transforming from high-speed to high-quality. China's major social contradiction has been transformed into the contradiction between people's increasingly needs of good life and imbalance development. Of course, this contradiction is determined by the supply-side reform. The government has invested a lot, but government investment alone is not enough, because many public goods are lacking today, including health, medical care, elderly care, education, and so on. To solve these social problems, we still have to rely on the concerted efforts of society. For example, old before rich, now elderly care problem is very prominent with "100 old people three beds". "13th Five-Year Plan" invested a lot for this matter, but we must focus on the whole society. In Zhejiang Province, there is a Lvkang Medical Care once was a people-run non-enterprise unit with 600 beds in ten years. Later, a Shanghai impact investing Education Bonus Capital invested in it, making it become the largest chain organization in Asia with 10,000 beds in three years, not only providing good service but also having low cost and price. This is a successful case of supporting the solution of social problems through impact investing. I remembered Drucker's words that all social problems can only be solved once they become profitable business opportunities.

In addition, the impact investing in poverty alleviation also has very positive impact. In order to eradicate poverty completely, we must attach importance to capacity-building and turn input transfusions into creation. It is better to teach people how to fish than to give them fish. General Secretary has said that eradicating poverty and achieving prosperity ultimately depends on the hard work of the poor masses. There is no mountain higher than human beings and no road longer than their feet. Impact investing contributes to capacity building.

Yesterday we discussed this problem, educational poverty alleviation is the fundamental way to cut off the poverty belt, and industrial poverty alleviation is the only way out of poverty and not returning to it, achieving sustainable poverty alleviation. How to achieve industrial poverty alleviation? It needs the support of finance, market power and science and technology. Financial support is of vital importance. We have found that financial problems have always been serious in poverty alleviation areas. We cannot imagine can we see a successful poverty alleviation via industries without the aid of finance. So inclusive finance and micro-finance play a key role. CD Finance has done a lot of work in the past to lift millions of poverty population out of poverty alleviation fund from the comes from? Yet where does the capital of China Foundation for Poverty Alleviation come from? It is from the impact investing, including Ant Financial and so on.

In addition, we also resort to market forces. For example, 15,000 female embroiders have been employed in 15 years to link folk cultural heritage with the market; by virtue of the commercial force, people in these poor mountainous areas have lifted out of poverty. A female embroider even earn up to RMB 1.2 million a year. The same is true of poverty alleviation via technology. In many places, poverty attributes to harsh conditions, instead of untalented people. The support of science and technology also needs impact investing. Impact investing can help lift people out of poverty and win.

General Secretary Xi Jinping said at the 19th National Congress of the CPC, "we should pursue a just cause for common good." Impact investing that brings benefits and profits simultaneously, is the combination of philanthropy and finance, and also the way of investment for sustainable development. We believe that China will become a power with respect to impact investing, and that capital will certainly become a force for social good.

Thank you.